Food Grade Carbon Dioxide Market to Reach USD 2.7 Billion by 2033, Growing at 6.0% CAGR from 2024-2033

Food Grade Carbon Dioxide Market size is expected to be worth around USD 2.7 Billion by 2033, From USD 1.5 Billion by 2023, growing at a CAGR of 6.0%

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- Report Overview

Food grade carbon dioxide is a high-purity version of CO2 that is used in the food and beverage industry for a variety of purposes. It must comply with strict specifications for purity and is used primarily to carbonate beverages, including soft drinks and beer. It also serves as a propellant and packaging gas in the food industry to inhibit the growth of bacteria and fungi, and to maintain product freshness without affecting taste or aroma.

The food grade carbon dioxide market is a sector that focuses on the production, distribution, and sale of high-purity CO2 for use in food processing and preservation. This market is influenced by the global demand for carbonated beverages and packaged foods, and it interacts closely with industries such as brewing, soft drinks manufacturing, and fast-moving consumer goods (FMCG).

The growth of the food grade carbon dioxide market is largely driven by the increasing consumption of carbonated beverages globally. Urbanization and rising disposable incomes have led to higher demand for soft drinks and packaged foods, which require food grade CO2 for carbonation and preservation. Additionally, technological advancements in CO2 extraction and purification methods have made the supply more reliable and cost-effective, further supporting market growth.

Demand for food grade carbon dioxide is directly linked to the food and beverage industry's need for safe and effective preservation methods. As consumers increasingly prefer convenience foods and carbonated drinks, the need for CO2 in these products continues to rise. Moreover, the trend towards more natural preservation techniques may boost the use of CO2 over synthetic preservatives, given its efficacy and minimal impact on food taste and quality.

Opportunities in the food grade carbon dioxide market are abundant, particularly in developing regions where the expansion of the food and beverage sector is rapid. Innovation in packaging technologies that use CO2 to extend shelf life without the need for refrigeration offers potential for market expansion. Additionally, the growing craft beer industry, which relies heavily on carbon dioxide for carbonation, presents a significant opportunity for suppliers.

Key drivers for the food grade carbon dioxide market include regulatory support for safe food preservation methods, technological advancements in CO2 capture and reuse, and the overall growth of the food processing industry. The shift towards sustainable practices in the food industry also drives the adoption of CO2 recovery and recycling technologies, reducing emissions and production costs while meeting the industry's demand.

Get a Sample PDF Report: https://market.us/report/food-grade-carbon-dioxide-market/request-sample/

Key Takeaways

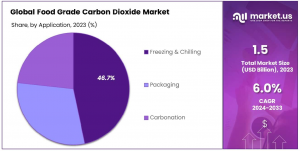

• The Global Food Grade Carbon Dioxide Market size is expected to be worth around USD 2.7 Billion by 2033, From USD 1.5 Billion by 2023, growing at a CAGR of 6.0% during the forecast period from 2024 to 2033.

• The Food Grade Carbon Dioxide Market in North America is valued at USD 0.6 billion, representing 37.6%.

• Gaseous state dominates with a 76.4% share in the market.

• Freezing & chilling leads usage at 46.7% in applications.

• Beverages remain the top end-use sector at 39.4% market share.

Food Grade Carbon Dioxide Market Segment Analysis

By Type Analysis

In 2023, the gaseous state dominated the Food Grade Carbon Dioxide Market with a 76.4% share, primarily used in beverage carbonation and modified atmosphere packaging to extend the shelf life of perishables. Liquid CO2, although less prevalent, is essential in quick-freezing and chilling applications in the food industry, such as in meat processing and dry ice production for transport. While gaseous CO2 is favored for its cost-effectiveness and ease of handling, both forms are crucial for food safety and quality, with potential shifts in market dynamics expected due to evolving regulations and technologies.

By Application Analysis

In 2023, the "Freezing & Chilling" application commanded a leading position in the Food Grade Carbon Dioxide Market, securing over 46.7% of the market share. This dominance is attributed to the essential role of CO2 in quickly lowering temperatures in the food sector, crucial for maintaining freshness, inhibiting bacterial growth, and extending the longevity of products, particularly in the meat and seafood industries. Meanwhile, the "Packaging" and "Carbonation" applications also held significant shares. Packaging employs CO2 in modified atmosphere packaging (MAP) to extend the shelf life of perishables by reducing oxidation, while Carbonation, essential for producing effervescent beverages like sodas and beers, continues to satisfy global consumer demand for fizzy drinks. Despite the strong lead of Freezing & Chilling, the diverse uses of food-grade CO2 across various applications promote balanced market growth, adapting to changing consumer tastes and advancements in food preservation technology.

By End-Use Analysis

In 2023, the Beverages segment led the Food Grade Carbon Dioxide Market, holding over 39.4% of the share, driven by its extensive use in carbonated soft drinks, beers, and sparkling waters. Consistent consumer demand for fizzy beverages ensures a strong reliance on food-grade CO2 for taste and preservation. Other key segments include Dairy & Frozen Products, which utilize CO2 for freezing; Meat & Poultry, relying on CO2 for processing and modified atmosphere packaging (MAP); and Bakery & Confectionery, using CO2 in freezing and texture enhancement. The Others category includes applications in horticulture, pH stabilization, and fire suppression. Despite the dominance of beverages, the broad usage of food-grade CO2 across industries underscores its versatility and market significance.

Buy Now: https://market.us/purchase-report/?report_id=121839

Key Market Segments

By Type

• Gaseous State

• Liquid State

By Application

• Freezing & Chilling

• Packaging

• Carbonation

By End-Use

• Beverages

• Dairy & Frozen Products

• Meat

• Poultry

• Bakery and Confectionery

• Others

Top Emerging Trends

1. Growing Demand for Sustainable CO2 Production: Sustainability is becoming a key focus in the food-grade carbon dioxide market, with industries prioritizing eco-friendly CO2 production methods. Companies are investing in carbon capture and utilization (CCU) technologies to reduce emissions and produce high-purity CO2 from industrial processes. This shift is driven by environmental regulations and consumer preference for sustainable food and beverage production. As industries adopt greener solutions, the market is expected to see increased innovation in CO2 recovery, leading to more cost-efficient and sustainable supply chains.

2. Rising Adoption of Modified Atmosphere Packaging (MAP): The use of modified atmosphere packaging (MAP) in the food industry is expanding rapidly, as it helps extend the shelf life of perishable products. CO2 is a crucial component in MAP, as it reduces microbial growth and maintains product freshness. The growing demand for packaged ready-to-eat meals, fresh produce, and meat products is fueling the adoption of MAP technology. As food safety regulations become stricter, manufacturers are integrating CO2-based packaging solutions to ensure product quality and reduce food waste.

3. Expanding Role in Frozen and Chilled Foods: The increasing consumption of frozen and chilled food products is driving the demand for food-grade carbon dioxide. Liquid CO2 is widely used in cryogenic freezing, ensuring rapid cooling while preserving texture and nutritional content. The growing popularity of frozen meals, dairy products, and seafood, particularly in urban markets, is accelerating the need for efficient freezing technologies. As logistics and cold chain infrastructure improve globally, CO2-based freezing solutions are expected to gain more traction in food preservation.

4. Innovation in Beverage Carbonation: Beverage manufacturers are continuously innovating carbonation techniques to enhance taste and texture while ensuring sustainability. The increasing demand for premium carbonated drinks, including craft sodas, flavored sparkling water, and non-alcoholic beers, is driving advancements in CO2 infusion methods. Companies are also exploring ways to optimize CO2 usage to reduce waste and environmental impact. With changing consumer preferences for healthier and naturally carbonated beverages, the role of food-grade CO2 in beverage production is evolving significantly.

5. Stricter Food Safety and Regulatory Compliance: Regulatory bodies worldwide are imposing stricter guidelines on food-grade CO2 to ensure product safety and quality. Compliance with purity standards, traceability, and contamination-free sourcing is becoming increasingly critical. Food and beverage manufacturers are investing in advanced purification and monitoring systems to meet stringent regulatory requirements. As consumer awareness of food safety grows, the demand for certified and high-quality CO2 will rise, pushing suppliers to maintain rigorous quality control and transparency in their supply chains.

Regulations on the Food Grade Carbon Dioxide Market

In the United States, the Food and Drug Administration (FDA) classifies carbon dioxide as Generally Recognized as Safe (GRAS) for use in food, provided it meets specific purity standards. According to Title 21, CFR 184.1240, carbon dioxide must be of a purity suitable for its intended use, with no limitations other than current good manufacturing practice. This includes its application as a leavening agent, processing aid, and propellant.

In India, the Food Safety and Standards Authority of India (FSSAI) has established guidelines for the use of carbon dioxide in food products. The Indian Standard IS 307:1966 specifies two grades of carbon dioxide: Grade 1, suitable for use as a reagent and for welding purposes, and Grade 2, suitable for beverages, fire extinguishers, refrigeration, and general commercial purposes. Grade 2 carbon dioxide must have a minimum purity of 99.0% by volume.

Additionally, FSSAI has issued advisories on the use of dry ice (solid carbon dioxide) as a cooling agent for food products. It is advised that dry ice should never be kept, stored, or transported in a closed environment to prevent the risk of carbon dioxide accumulation, which can be hazardous.

Globally, organizations such as the International Society of Beverage Technologists (ISBT) and the European Industrial Gases Association (EIGA) have set standards for beverage-grade carbon dioxide, typically requiring a minimum purity of 99.9%. These standards ensure that the carbon dioxide used in food and beverages is free from harmful contaminants and suitable for consumption.

Regional Analysis

The Food Grade Carbon Dioxide Market varies across regions. North America leads with a 37.6% share (USD 0.6 billion), driven by food and beverage applications. Europe follows, supported by strict food safety regulations and a strong industrial base.

Asia Pacific is the fastest-growing region, fueled by rising consumer demand and expanding manufacturing in China and India.

The Middle East & Africa market is emerging, with growth linked to urbanization and food safety investments. Latin America sees steady demand, particularly in the beverage sector, with Brazil and Argentina leading carbonation-related consumption. Overall, global demand is rising due to increasing food processing needs.

Key Players Analysis

◘ Air Liquide

◘ Air Products

◘ Linde

◘ Matheson

◘ Messer

◘ POET

◘ Reliant

◘ Carbonic Systems

◘ ACAIL GÁS

◘ Greco Gas Inc.

◘ Sicgil India Limited

◘ SOL Group

◘ Strandmøllen A/S

◘ Taiyo Nippon Sanso Corporation.

Recent Developments of Food Grade Carbon Dioxide Market

— In 2023, Air Liquide reported revenues of €29.9 billion, with a net income of €3.08 billion. In 2024, the company announced an acceleration of its ADVANCE strategic plan, doubling its margin ambition.

— In 2023, Linde achieved revenues of $33.4 billion and a net income of $6.199 billion. The company continued its focus on hydrogen energy projects, emphasizing sustainable industrial solutions.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release